SWAN has invested in ClearFlame Engine Technologies, Inc

The heavy-duty engine industry is approaching a time when the rising cost of petroleum-based diesel fuel—and continued government regulation of CO2 and diesel criteria pollutants (NOx and particulates)—are leading to the decline of diesel-fueled engines. Heavy-duty engine manufacturers are aggressively seeking viable alternative technologies. ClearFlame Engine Technologies is introducing a disruptive, patented engine technology that easily integrates into existing compression ignition engine manufacturing which delivers uncompromising engine performance at a lower cost.

ClearFlame Engine Technology has the potential to reduce well over five gigatons of greenhouse gas emissions by 2050.

Our network’s investment was part of the company’s $3M funding round.

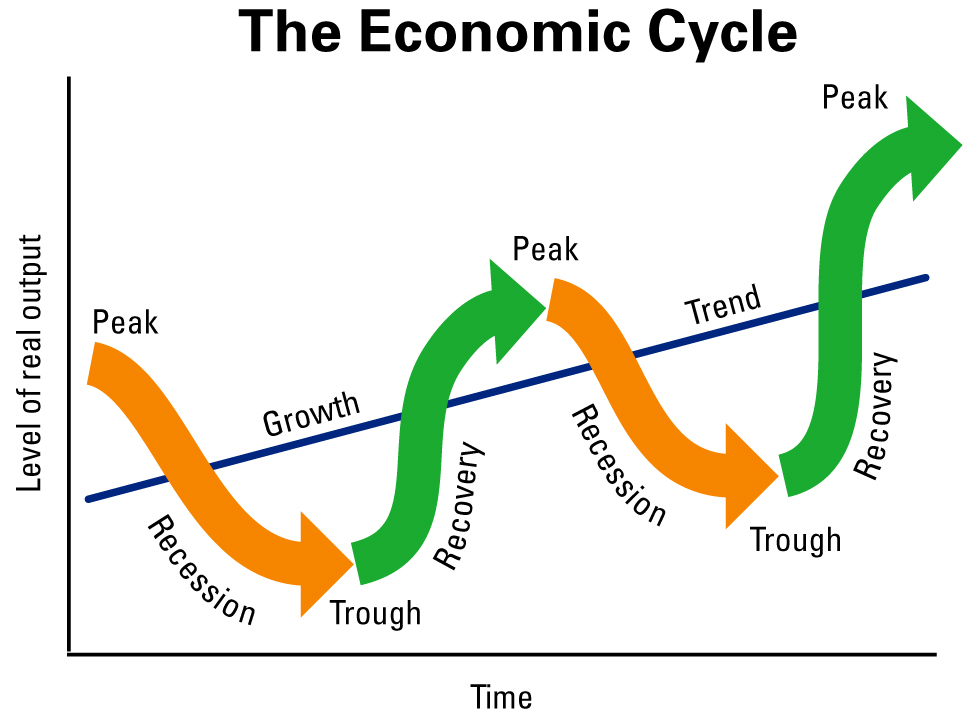

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

Acadeum was founded by 2016 and the Southwest Angel Network was one of the early investors in 2017. Acadeum, previously known as College Consortium, offers a software platform that allows universities to share online courses. Students today can face challenges with earning a degree on a timely basis because the students are burdened by a lack of access to needed classes at the needed time. Making classes more available can increase graduation rates and decrease the time to graduation.

Acadeum was founded by 2016 and the Southwest Angel Network was one of the early investors in 2017. Acadeum, previously known as College Consortium, offers a software platform that allows universities to share online courses. Students today can face challenges with earning a degree on a timely basis because the students are burdened by a lack of access to needed classes at the needed time. Making classes more available can increase graduation rates and decrease the time to graduation. Our network is pleased to announce a follow-on investment in OneSeventeen Media. The company improves the social-emotional well-being of youth, and reaches those youth through partnerships with employee benefit programs and with schools.

Our network is pleased to announce a follow-on investment in OneSeventeen Media. The company improves the social-emotional well-being of youth, and reaches those youth through partnerships with employee benefit programs and with schools.

The mission of

The mission of  Skyven

Skyven