From the Desk of Juan Thurman, Director, SWAN Impact Network

The SWAN Impact Network started 2020 excited about the year. We put forth aggressive goals and plans to achieve them. We had our first quarterly pitch dinner in person in February on the campus of St. Edwards’s University. They were great hosts and we had 3 interesting pitches, a good dinner, and a vigorous exchange of ideas.

The Impact of Covid

Then the pandemic hit. Like most, we were caught flat footed and at first did not know how to react. Then our Executive Director, Bob Bridge, and our amazing board snapped into action. We moved all our events online and in April offered a webinar, attended by 200 investors and entrepreneurs, that addressed investing during the pandemic.

Then, most importantly, we reached out to all our portfolio companies to see how they were impacted by the pandemic and if they needed help. We had productive, if difficult, discussions. Those conversations led to four of our portfolio companies receiving a follow-on investment to help them weather the covid-related economic crisis.

We found our footing mid-year and adjusted. We experienced a slowdown in Q2 that leaked into Q3. Fewer entrepreneurs applied and investors were more conservative with their capital, but we moved forward confident that things would get better and that impact investing is even more important now. The upside was that geography became less of an issue and we had more out of state and international applicants than ever before. In that spirit, our Angels selected and funded 3 new companies in 2020. And we are now, in January, funding two companies that began due diligence in 2020.

Our Good News in 2020

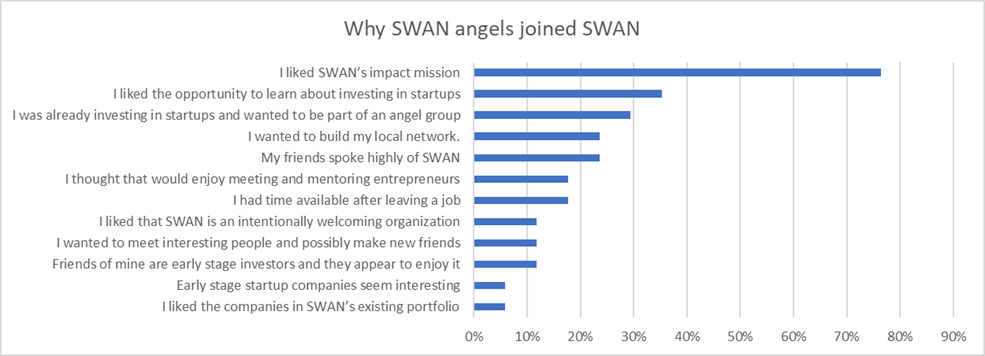

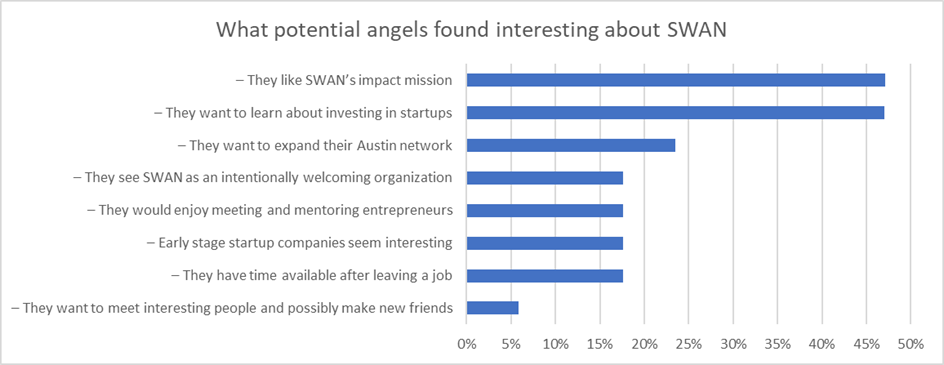

2020 had its share of silver linings and for that we are grateful to our angels, sponsors, entrepreneurs, associate members, interns, and the greater impact community. We ended 2020 with nearly 60 angels and having invested over $6M in social impact companies since our inception in 2015.

Some of our portfolio companies were able to raise venture capital in 2020 and one merged with a larger company. All our portfolio companies that went into the pandemic with trepidation have come out stronger and more resilient.

We have added board members and associates keeping diversity and inclusion in mind. Speaking of diversity and inclusion, we have added a chapter in Dallas and a new Executive Director, Heather Gilker, to run it. We are excited about SWAN in the big D.

Looking toward an Exciting 2021

We are off to a fast start in 2021. In January we are investing a total of over $1M in two companies from our 2020 funding cycles. And we are in the middle of our Q1 down selection process and will invite 3 promising impact startups to pitch to the network on February 11th.

We are also rebranding the network and have done a complete overhaul of our website. Southwest Angel Network has served us well, but as we continue to expand and see deals from of all over the US, we have decided to rebrand as the SWAN Impact Network.

Lastly, we have launched the SWAN Impact Fund. The fund will work alongside the network and invest in later stage deals focused on health tech and clean energy. Please keep an eye out for a more formal announcement in the coming months.

If you have impact investing in your 2021 plans or are interested in learning more please visit our website, swanimpact.org and connect.

2020 Follow on Investments:

OneSeventeen Media

Accelerist

Curb

Family Plan

Shyft

2020 Initial Investments

Don’t Get Mad Get Paid

SpeechVive

ClearFlame

The Texas Global Health Security Innovation Consortium (TEXGHS) is a consortium between Texas academia, public sector, and private sector partners to coordinate efforts to support companies working towards pandemic readiness, response, recovery and resiliency in Texas.

The Texas Global Health Security Innovation Consortium (TEXGHS) is a consortium between Texas academia, public sector, and private sector partners to coordinate efforts to support companies working towards pandemic readiness, response, recovery and resiliency in Texas.