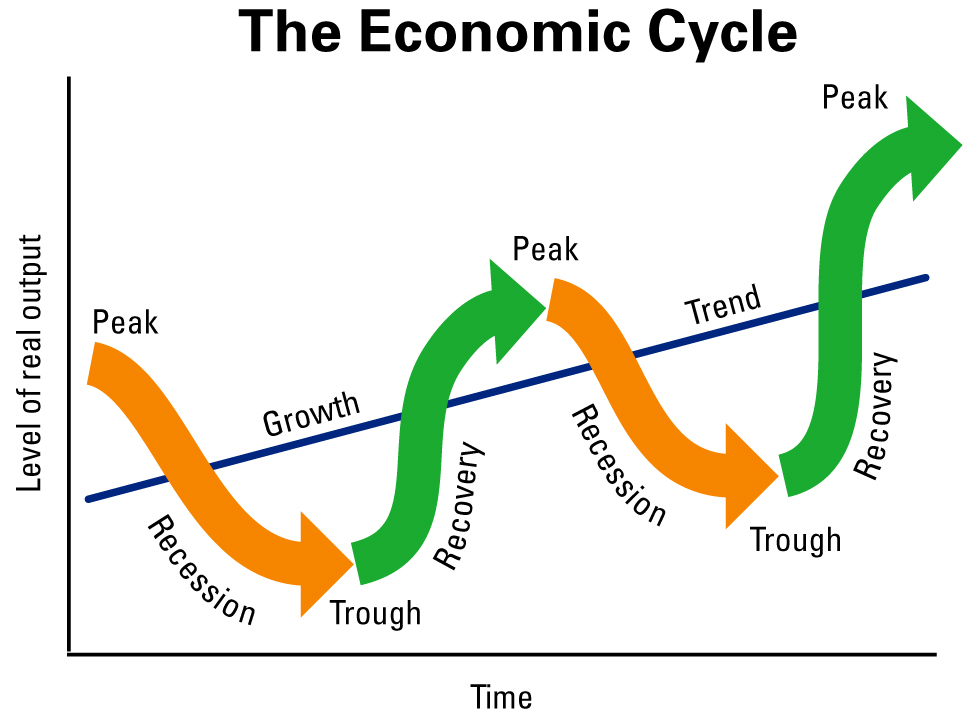

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

That said, from a company’s point of view, a financial down turn can be a good time to create an early-stage start-up.

- There will be fewer competitors of your same vintage, which can help lesson competition in the marketplace and with investors. This advantage persists over time. As the economy recovers from a downturn, companies will see fewer other companies at their specific stage of fund-raising. Said another way, when your company becomes a teenager, there will not be many teenagers around vying for attention.

- Operating costs often get more reasonable (e.g., lower cost of office space)

- It can be easier to bring on early employees (who may have been laid off)

And from personal experience, I know that a down turn is a really difficult time to for a company to raise a many million-dollar, later-stage VC round. During the 2008 recession, I had to sell my company at a loss to the investors because I could not raise a $12M series C round.

For investors, capital-efficient, pre-seed companies who can get by for a few years on minimal dollars suddenly looking pretty interesting. And the current environment means that pre-money valuations and valuation caps will be more attractive. The balance of power has shifted somewhat toward investors.