Overview of the Deal Memo Process

Introduction

SWAN deal memo work is led by a deal lead who works with section contributors. The section contributors work on one section of the memo, for example, team, finance or marketing and sales.

However you decide to help, you will find the work both interesting and highly educational. Your ability to confidently evaluate a startup will increase. And you will also get to better know other SWAN members, increasing your sense of belonging to a group dedicated to making the world a better place.

If you have not helped before, you will be well supported and you will realize, when the memo is finished, that you really do have the skills and experience required to contribute. Your life experience is all you need to bring to the table.

Start Your Education here!

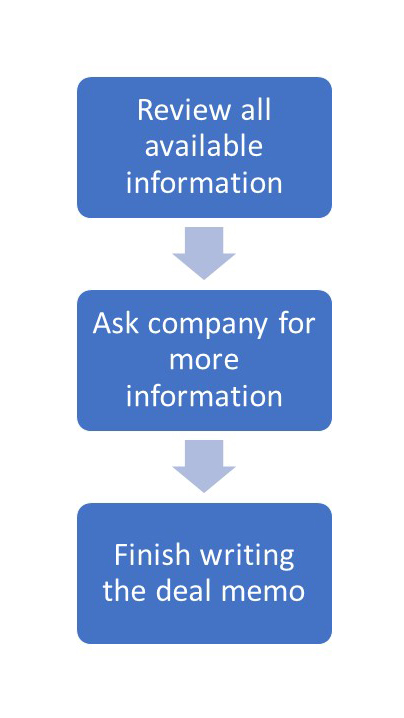

The Deal Memo Development Guidelines 2023-09-07 provides a complete description of the process by which a deal memo is written.

The Deal Memo Template 2024-07-09 is the template for Deal Memo and provides a complete description of the process by which a deal memo is written.

Considering being a Deal Lead?

A good place to start, the reflections of a first-time deal lead.

Deal leads are required to be a SWAN member (angel, associate or intern) and to have worked on a prior deal memo.

Considering being a Section Contributor?

In some cases, we will have several people working on one section.

An “Introduction to Writing a Deal Memo Section” provides a step-by-step cookbook for section contributors You can view the material in one of two ways, whichever you prefer, as a a 12 minute video and a pdf. (Please note that the video mentions a Slack channel that is no longer in use).

The Angel Investing 201 webinar slides (and video) gives some guidance for each section of the deal memo. The Angel Investing 202 provides information on deal terms.

Getting Help from Non-SWAN Members

We reach out to Subject Matter Experts (SMEs) when we need advice on a specific market or technology. To engage with a SME, please first check with Associate@swanimpact.org to see if they are already registered in our system. If they are not, have them return a Subject Matter Expert Application to Associate@swanimpact.org.

If you would like for someone outside of SWAN to help draft a deal memo, please invite them to become a Guest Angel, and have them return the Guest Angel application to Associate@swanimpact.org.