SWAN portfolio company Clear Flame Engine Technology is in the news.

Diesel-powered trucks can run on renewables, thanks to this new Gates-backed tech. The fuel isn’t emissions free, but startup ClearFlame Engine’s retrofits could drastically cut the footprint of trucking right away.

The diesel big rig is starting to move into the carbon-free future: Electric semi trucks are already beginning to make deliveries around the country. But although they can work well for short trips—and Volvo’s newest electric semi will be able to travel up to 275 miles before charging—they still aren’t yet a viable alternative for the trucks that have to cross the country, which is how so much freight is moved. That’s why one startup is working on technology that can be put in use now: It tweaks diesel engines so they can use 100% renewable fuel, with no change in how the trucks run.

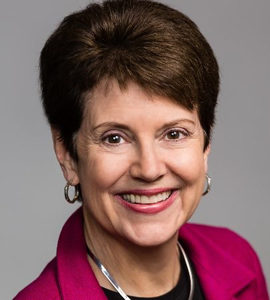

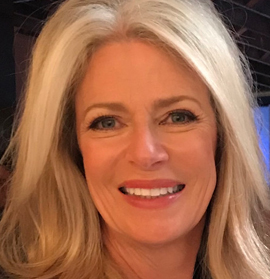

“Rather than trying to design an entirely new engine from the ground up, we said, okay, what is the minimum subset of parts and components we could swap inside this engine to make it fundamentally fuel agnostic, and to switch to something cleaner?” says BJ Johnson, CEO of the startup, called ClearFlame Engine Technologies, which recently raised $17 million from investors including Bill Gates-founded Breakthrough Energy Ventures.

In a new pilot test, the company converted the engine in a Class 8 truck—the largest class of trucks, weighing a minimum of 33,000 pounds—and tried driving it on 100% plant-based ethanol on a test track. There was “no loss of efficiency, no loss of power,” says cofounder Julie Blumreiter, who began developing the technology with Johnson when both were studying at Stanford University. “It sounds the same. It is a diesel engine in every sense of the word besides the fuel you use.” The key difference is the lack of pollution: Instead of black diesel smoke belching out of the tailpipe, the exhaust looks clear, and air pollution and climate emissions dramatically shrink.

Ethanol, which is typically made from corn, still has a carbon footprint, including the climate impact of fertilizer used to grow the crop. But current lifecycle data suggests that pure ethanol emits around 45-50% less greenhouse gases than diesel. And because the electric grid is still shifting to renewable electricity, the startup claims that a truck running on 100% ethanol is actually cleaner, at the moment, than an electric truck.