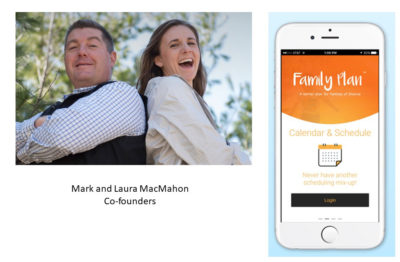

The Southwest Angel Network is please to participate in follow-on funding for Family Plan. SWAN made a seed investment in September of 2018. Since that time Family Plan has made significant progress and has now closed a multi-million dollar round.

Family plan works to reduce the stress on a family following a divorce. Using Family Plan, parents can manage custody scheduling on a shared calendar in real time, arrange and make payments instantaneously and with authentication, and make and log texts and emails to support open communication and maintain a reliable record. No other mobile app provides this suite of functions. This app has been developed with input from a team of divorced parents, divorce lawyers, and ex-judges to address both an important social need and a large market opportunity.

Family Plan was founded and is led by Mark and Laura MacMahon, from Maine, who founded the company for the same reason many companies are founded – they had a problem they wanted to solve, and the available solutions just weren’t good enough. In the years after Mark’s divorce, he found that he was spending hours a week just trying to stay on top of managing his schedule, finances, and communications all related to the kids. Mark and Laura decided to build a set of tools that would help families thrive after a breakup – reducing conflict along the way.

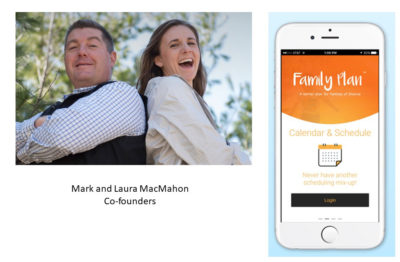

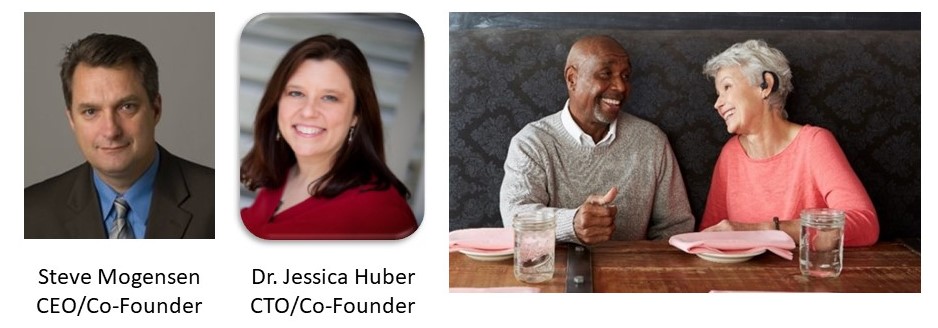

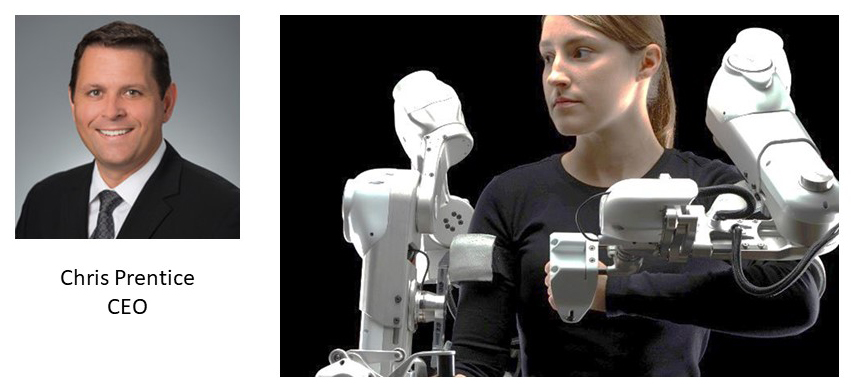

The Southwest Angel Network is working to support portfolio companies in these uncertain times, and is pleased to announce an incremental investment in Shyft Power Solutions.

The Southwest Angel Network is working to support portfolio companies in these uncertain times, and is pleased to announce an incremental investment in Shyft Power Solutions.

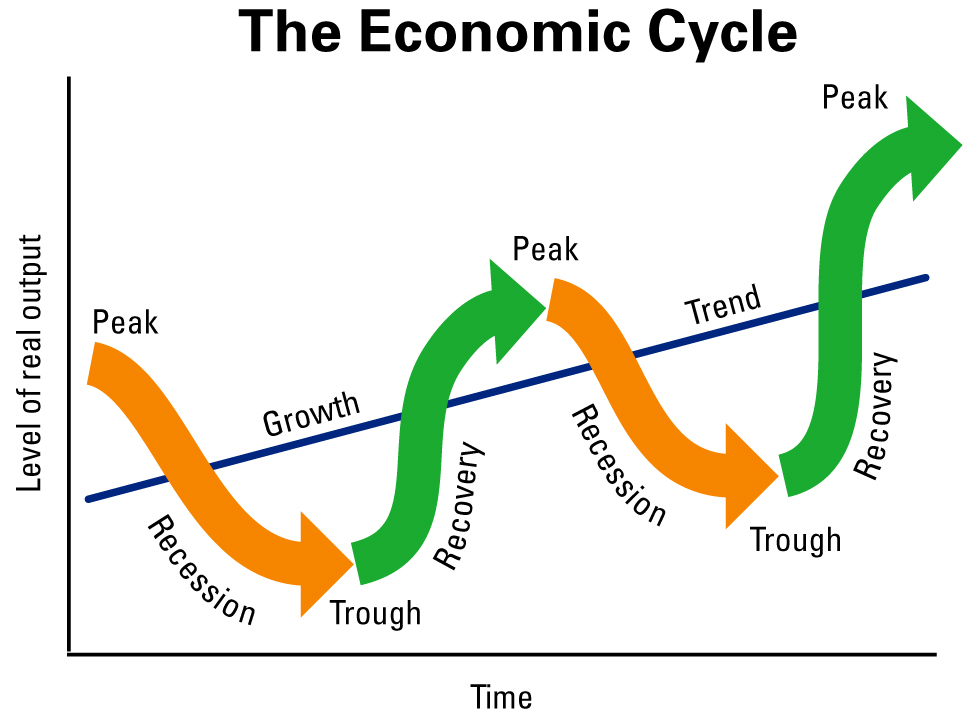

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

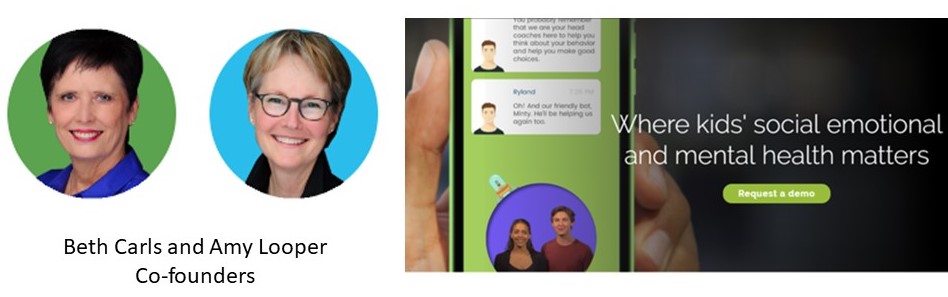

Our network is pleased to announce a follow-on investment in OneSeventeen Media. The company improves the social-emotional well-being of youth, and reaches those youth through partnerships with employee benefit programs and with schools.

Our network is pleased to announce a follow-on investment in OneSeventeen Media. The company improves the social-emotional well-being of youth, and reaches those youth through partnerships with employee benefit programs and with schools.

The mission of

The mission of  Skyven

Skyven