What Angels are saying about Impact Investing

Thinking about becoming an impact investor? Are your thoughts and questions the same or different from others? What are they saying?

The Southwest Angel Network recently conducted a survey regarding what makes impact investing attractive and what holds back a decision to become an impact investor.

Here is what we learned.

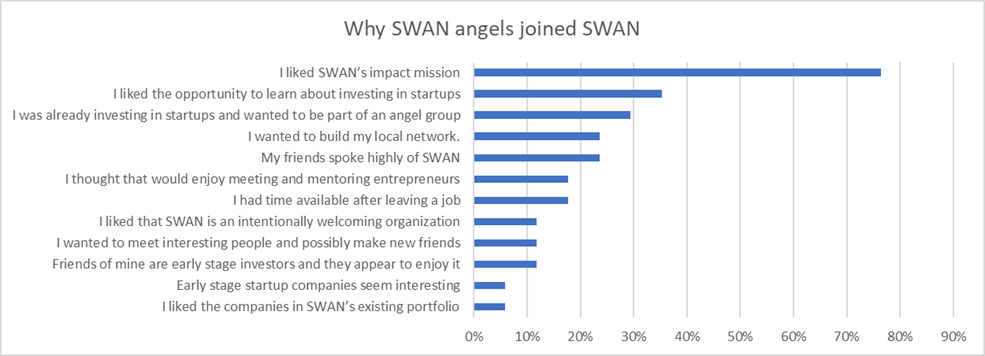

Why SWAN angels joined SWAN

Survey Question: When you were personally considering joining SWAN what were the top two most compelling factors that most attracted you?

Survey Answers: For SWAN angels, by far the biggest appeal was a desire to make a positive impact on the world. Secondly, many of the angels had no prior angel investing experience and wanted to learn about investing. SWAN is structured to provide that education.

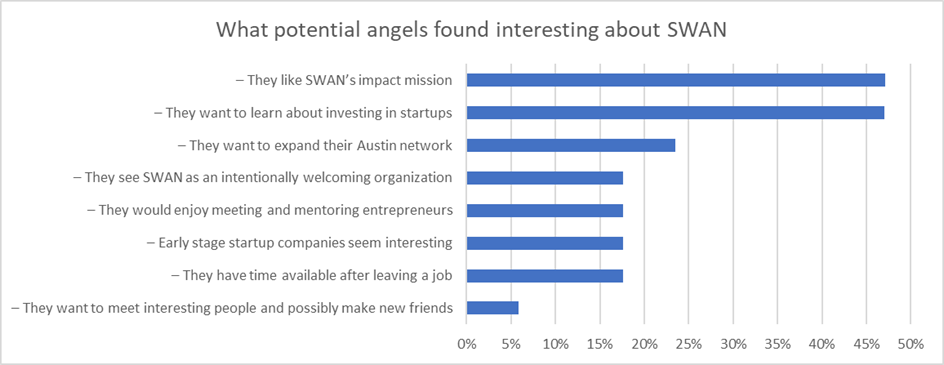

What potential angels liked about SWAN

Survey Question: When our SWAN angels have introduced SWAN to other potential angels, what are the ideas that most strongly resonate?

Answer: Just like the folks who have joined, potential angels like our impact mission, and the ability to learn about angel investing.

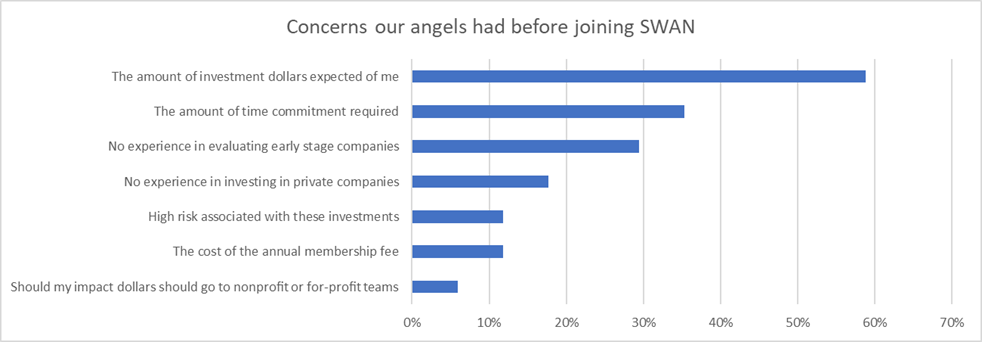

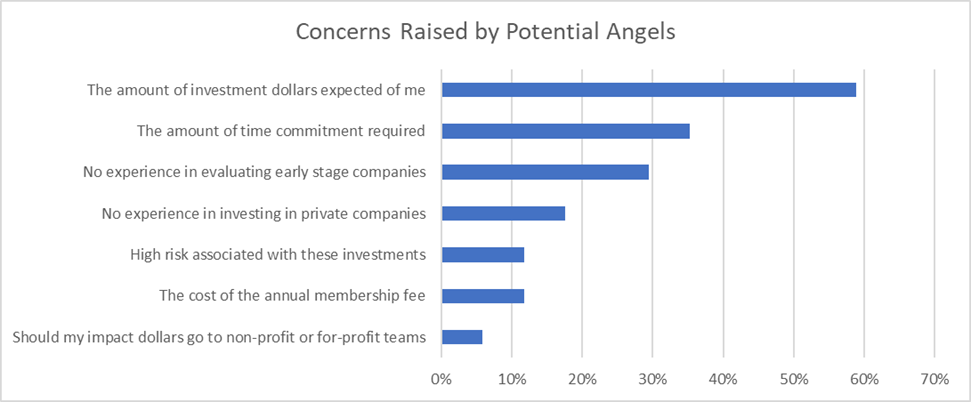

What holds people back from becoming Impact Angels

Survey Question: We asked our angels what their pre-joining concerns were and also what concerns they heard when introducing SWAN to potential angels.

Survey Answers: The primary concerns were the amount of investment dollars required , the amount of time required and their lack of experience in angel investing.

The good news is that SWAN assumes that new angels have no startup investment experience. We encourage new SWAN angels to not start investing until they have benefited from our educational webinars and have observed how our experienced angels think about assessing investment risks during our down-selection and due diligence processes.

Further, SWAN does not have a required minimum investment amount. Rather, we suggest that angels think top-down about how much of their assets they are willing to put into Impact investing, and then determine how to use that budget to build a portfolio of 20 investments over a period of years.

And typical of the 80/20 rule, some of our angels enjoy spending significant time advancing the mission of SWAN. And for others, the perfectly reasonable commitment of time is attending our quarterly pitch events, and reading the due diligence reports that SWAN has produced as the final step before we ask angels if they would like to invest in a company that has made it through our rigorous evaluation process.

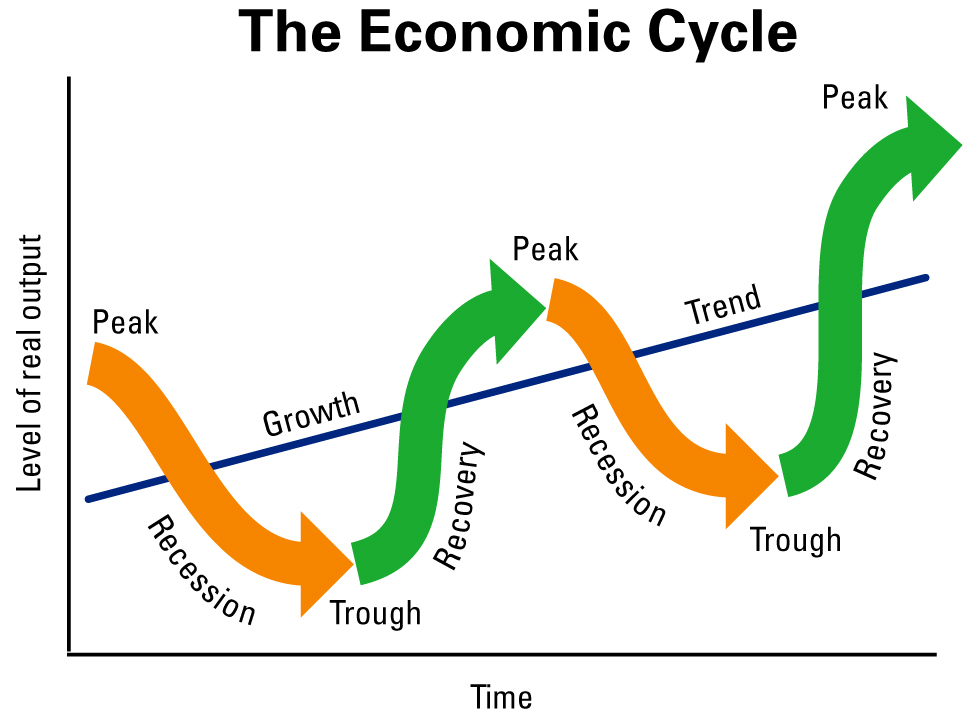

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

I have been around startup companies for 35 years and have experienced both good and bad economic cycles. We have now entered uncertain times.

From the desk of Bob Bridge.

From the desk of Bob Bridge.