Technologies that support Virtual Power Plants can provide interesting investment opportunities for angel investors.

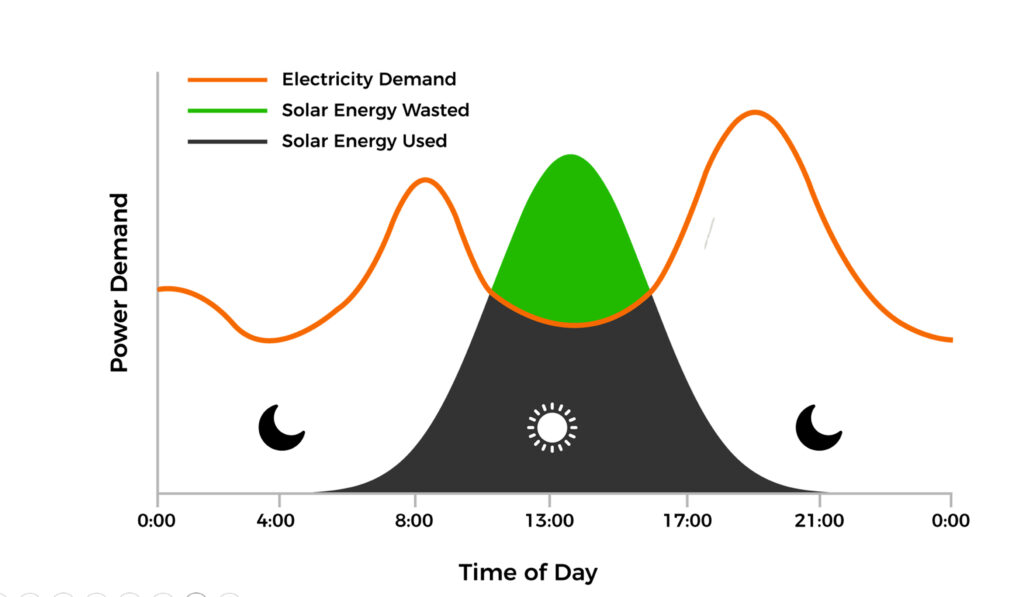

Electrical power demand varies dramatically over the course of a day, and that demand is out of sync from when renewable electricity is generated. If demand and supply could be brought into sync, there would be less demand for non-renewable-fueled power-plant capacity.

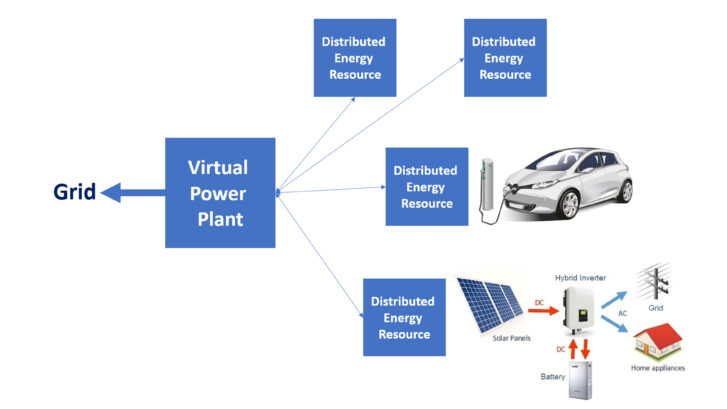

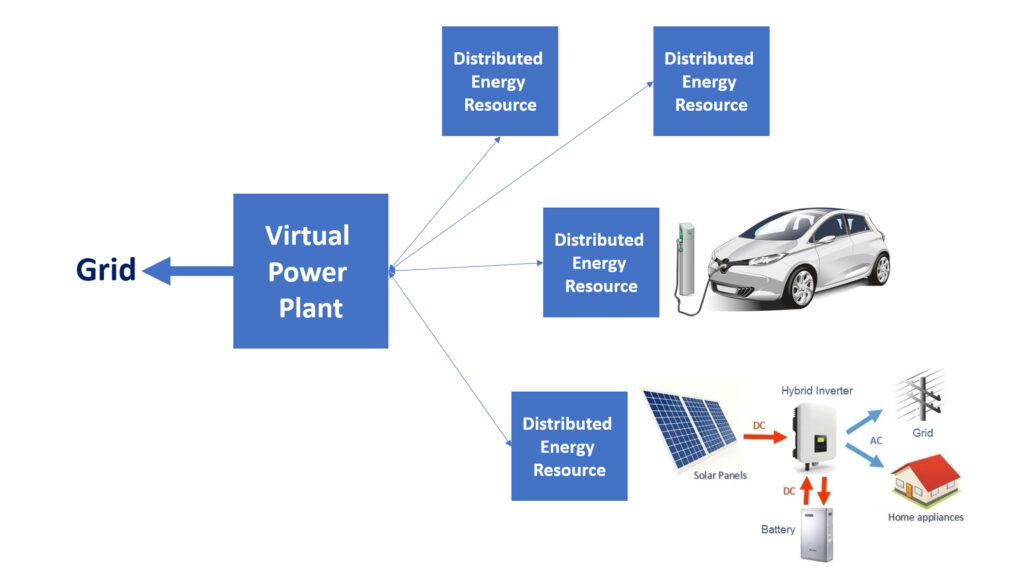

An emerging solution is Virtual Power Plants (VPPs) that can draw on and aggregate behind-the-meter Distributed Energy Resources (DERS) at peak-demand times. A VPP can balance electrical loads and provide utility-scale and utility-grade grid services like a traditional power plant)

DERs are equipment located on or near the site of end-use (for example, behind the meter) that can provide electricity at a small scale when needed by the grid. For example:

- Electrical vehicle batteries that were charged with demand on the grid was low.

- Residential solar/battery systems that store power during the day when residential demand is low.

Projections show that VPPs in the US will be able to exceed the capacity of all US nuclear power plants.