If you are undecided about becoming an angel you may find the following “Questions and Answers” to be helpful.

If you have any questions or concerns not addressed by the following or would just like to chat, please contact Bob Bridge, bob.bridge@swanimpact.org.

What is it like to be an angel investor with the SWAN Impact Network?

The highlight of being an angel is the dinner pitch event, where pre-screened social-impact companies present their stories, followed by questions from everyone in the room. The companies are interesting. The questions are insightful. And you get to meet and visit with friendly and knowledgeable angels and mentors. To request being a guest at a dinner event, please contact Bob.

Furthermore, you can help pre-screen (down select) the companies by participating in online presentations by the companies. Being part of the pre-screening is an opportunity, not a requirement, and we try to match screeners with companies in their area of expertise.

After hearing a company present at a dinner pitch event, and if you are open to considering an investment in a company, you can support further due diligence, where we dig deeper and work to verify the company’s story.

A key part of the experience of being an angel is the enjoyment of working collaboratively with angels and companies.

What are the benefits of joining the angel network? How does the network help me? Answer: Key benefits are:

- Having the opportunity to learn about angel investing from experienced angels

- Seeing pre-qualified deals. Typically, 10% of the companies who apply get to present at our dinner pitch event

- Benefiting from group-think. All the angels bring different experiences and collectively we have better insights about a company than any of us have individually

- Attending fun and interesting dinner pitch events

- Being part of a social community, meeting interesting people and companies, and gaining the satisfaction of working with others to make the world a better place

- Having your SWAN investments tracked in the SERAF platform, which is continually updated to show the value of your personal portfolio

- Having access to the Dealum platform which makes it easy to make investment decisions. All the information you need to review for potential investments is in one user-friendly location.

- Having access to the information provided by the Angel Capital Association (ACA). ACA is a trade group of angel networks and provides access to industry trends, and has educational webinars and annual conferences.

How does the network decide what companies will be presented to angels?

- Each quarter we typically have 30 companies apply. We then go through a two-step down-selection process. In the first step, the Executive Director selects the 8 or 10 most interesting companies. Those companies then participate in step two, where the companies do an online presentation. All our angels and mentors are invited to be part of the on-line presentation, and we work to include domain experts in the on-line meeting. We then decide on three companies to present at our dinner event.Key metrics we consider include the quality of the management team, the business’s social impact, the size of the market, the uniqueness and value of the company’s solution, the company’s traction in the market and deal terms. In summary, we are looking for companies addressing significant societal challenges and who should be able to build growing and profitable businesses.

How much do I need to know before becoming an angel investor?

You need to know that:

- You would like to learn more about angel investing by observing the process before you make your first investment

- You would find it satisfying to support social-impact companies

- You would enjoy the social aspects of being in a network of friendly, like-minded people

How much do I need to know before deciding to invest in a company?

We encourage you to observe several company presentations, to be part of screening processes and to help in due diligence before you make your first investment. At some point in time, you can decide that you are comfortable making an investment

How do the angel network work with companies after an investment is made?

The network does not invest and forget. If our network has been the lead investor in a round of financing for a company, we typically get a board seat or a board observation seat. Sometimes other investors have led the round, and we expect a representative of that investor will be on the board. In any case, we get quarterly reports from the company. And if you have some expertise especially useful to the company, there is the possibility of you being an advisor to the company.

Why join a network when it is possible to see deals apart from a network?

By being part of the network, you will see only the most interesting companies. Only about 10% of the companies that apply make it through our preliminary screening. And being part of a network is a friendly, social experience – you will enjoy evenings spent with like-minded members of our community as they have discussions with interesting companies.

How much of my time will it take?

As much or as little as fits your schedule. We hope that you will join us for four evenings a year for the dinner pitch events. If you have the time and interest we would welcome your participation in our quarterly down-selection. And if you are considering investing in a specific company, it is helpful to you and the network to participate in due diligence activities. If you are highly interested in a company going through due diligence, you can volunteer to be the deal lead, meaning that you manage the due diligence process.

How much do I have to invest?

The simple answer is as little or as much as you like. The conventional wisdom for angel investing is that angels need to make 10 to 20 investments to achieve a positive return. Making 20 investments at $25k per investment requires $500,000. Because that investment amount is prohibitive for many, the network provides two investment options:

- In the traditional angel model, the minimal investment size is $25,000. The SWAN Impact Network’s expectation for this option has been and remains the following, “Consider making two $25,000 investments per year. Investments are an expectation and not a contractual obligation”.

- In the 5×10 model, investors decide to make 10 investments of $5,000 each, spread over 3 years. In the 5×10 approach, angels are not limited to investing $5,000 and may invest a larger amount.

What are the risks?

Angel investment is risky. The rule of thumb is that you need to make 10 or 20 investments to make an overall return. The 5×10 investment model helps to mitigate the risk for those wanting to invest smaller amounts. You should be investing from discretionary funds and not from your retirement funds.

What is the annual contribution required of angel members?

The contribution amount depends upon whether you are local to one of our chapters, or are remote from those locations:

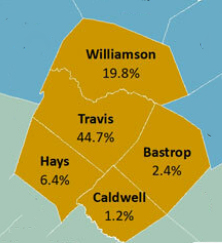

- $2,000 annually for new members, if you live within the Austin, North Texas or Houston MSAs (Metropolitan Statistical Areas) as shown in the maps below. $1,800 for renewing members.

- $1,250 annually for new members if you live outside of those MSAs. $1.050 for renewing members.

If renewing your membership, your contribution will be discounted by $200 from the rates above.

And keep in mind that the angel network is a 501(c)(3), non-profit organization and your membership fee is charitable donation

Where can I find more information on angel investing?

The SWAN Impact Network is a member of the Angel Capital Association. They have some excellent information at here.

What makes the SWAN Impact Network different from other angel networks?

Austin, Texas provides wonderful opportunities for angel investors to get involved with the start-up community. There is CTAN, the Capital Factory, Tech Stars and other groups too numerous to mention here. What makes the SWAN Impact Network unique is that we are one of just a handful of angel networks in the US with a focus on social impact, on doing good, and on making the world a better place. We are a source of positive energy for our angels at a time when the country is filled with divisiveness and negativity. And we see deal flow from social-impact companies from across the US, and occasionally from Europe. We show our angels amazing social-good companies.

Additionally, the SWAN Impact Network supports equal access to capital for companies with diverse management teams, and has taken the Startup Diversity and Inclusion Pledge. At the end of 2017, fully one-half of our investments to date have been in companies led by women or by minorities.

Is it possible to simply make a charitable contribution to help the companies?

The angel network has a Philanthropic Fund that allows you to make a charitable, tax-deductible gift that will be invested in those impact companies that have been invested in by the angel network. Positive returns to the Philanthropic Fund are used to make additional investments. If you are interested, please email Associate@swanimpact.org

What is the next step?

Visit one of our angel educational meetings, or visit one of our dinner pitch events. To attend one of these please contact Bob Bridge, (512) 658-2240 or Bob.bridge@swanimpact.org

How do the finances of the network work?

The angel network is a 501(c)(3) non-profit that is supported financially by the angel membership fees. We do not charge companies an application or success fee. We do not have a fund and therefore there are no management fees or carry fees. 100% of the angel investment dollars go directly to the company unless there is a required expense associated with an investment, for example, the setting of a Special Purpose LLC to pool investor dollars.

Why does SWAN prefer Convertible Notes over SAFE Notes?

The short answer is that SAFE notes provide no interest earnings and provide fewer protections for investors. Learn more.